MGM China reported net revenues of US$714 million for the second quarter of 2023, an increase of 5 percent when compared to the second quarter of 2019.

Depois de meses em queda, o mercado do jogo VIP da RAEM ainda mexe, mostrando uma recuperação sequencial de 42 por cento no segundo trimestre deste ano. Bacará continua a dominar a recuperação do mercado de massas, com resultados de outros tipos de apostas ainda muito reduzidos

mar23

SJM Holdings says it is expecting to record a loss of HK$7.8 billion for 2022.

The estimation was made in a regulatory filing to the Hong Kong Stock Exchange and represents a ballooning of the HK$4.14 billion loss posted in 2021.

Included in the estimate, the company says, is an “impairment charge” of HK$1.2 billion “being the amount, as of 31 December 2022, of the carrying value of the cost of refurbishments made to the Jai-Alai Building over a number of years.”

https://macaonews.org/business/sjm-macau-2022-results-macao/?utm_source=Newsletter&utm_medium=email&utm_content=8+March+Daily+Read&utm_campaign=20230308_Daily+Newsletter + https://agbrief.com/intelligence/deep-dive/08/03/2023/sjm-confirms-993-million-loss-for-fy22-with-major-drop-in-vip-and-slowdown-in-mass/?utm_source=Asia+Gaming+Brief&utm_campaign=2306d784c6-EMAIL_CAMPAIGN_5_19_2022_13_42_COPY_01&utm_medium=email&utm_term=0_51950b5d21-2306d784c6-69255637&ct=t(EMAIL_CAMPAIGN_5_19_2022_13_42_COPY_01)&goal=0_51950b5d21-2306d784c6-69255637&mc_cid=2306d784c6&mc_eid=31e20475e6

mar23

Melco Resorts & Entertainment Limited has reported a net loss of US$930.5 million (approximately 7.5 billion patacas) for 2022, up from the loss of US$811.8 million (6.5 billion patacas) it incurred in 2021.

In a regulatory filing to the Hong Kong Stock Exchange, the casino operator’s CEO, Lawrence Ho, highlighted the impact of “travel restrictions imposed across mainland China and Macau” during the pandemic.

The company posted US$337.1 million (2.72 billion patacas) in total operating revenues for the fourth quarter of 2022, representing a decrease of approximately 30 per cent from the US$480.6 million (roughly 3.8 billion patacas) for the comparable period in 2021.

https://macaonews.org/business/melco-results-2022/?utm_source=Newsletter&utm_medium=email&utm_content=3+March+Daily+Read&utm_campaign=20230303_Daily+Newsletter

fev23

Las Vegas’ casino revenue has hit higher than Macau for the first time in 18 years as the casino sector in the city struggled to ride out the pandemic storm that brought heavy losses.

In a historic moment for the sin city, the casino hub surpassed Macau’s gross gaming revenue (GGR) for the first time since 2005, when Vegas earned around USD200 million more.

However, the instance may just be a one-off due to the setbacks the industry faced in 2022.

The gaming sector has faced a double whammy with the pandemic restrictions as the city adhered to Beijing’s strict Covid policy, a crackdown on cross-border gambling kept casinos mostly empty for much of 2022, as well as the uncertainties due to the pending licensing renewals of the six gaming concessionaires.

Aside from trying to make up for the losses given they have been bleeding cash since 2020, casino operators were dealing with the extra burden of trying to expand non-gaming ventures as a requirement for the license renewal.

https://macaudailytimes.com.mo/las-vegas-topping-macaus-ggr-in-2022-only-one-off.html

jan23

Macau Chief Executive Ho Iat Seng said Thursday that the government will maintain its 2023 gross gaming revenue forecast of MOP$130 billion (US$16 billion).

“This year’s budget states that gross gaming revenue is MOP$130 billion, and the average monthly gross gaming revenue need to be more than MOP$10 billion,” Ho said. “The government will not revise this forecast for the time being and hopes that all sectors of the community will work hard to achieve this figure.”

He also noted that Macau’s economy is starting to show signs of recovery and it is important to wait and see the prevailing economic situation.

The government initially estimated GGR for 2023 at MOP$130 billion when announcing its budget in November. This forecast was exactly the same as in each of the past two years, although the real GGR figure fell well short in both 2021 and 2022.

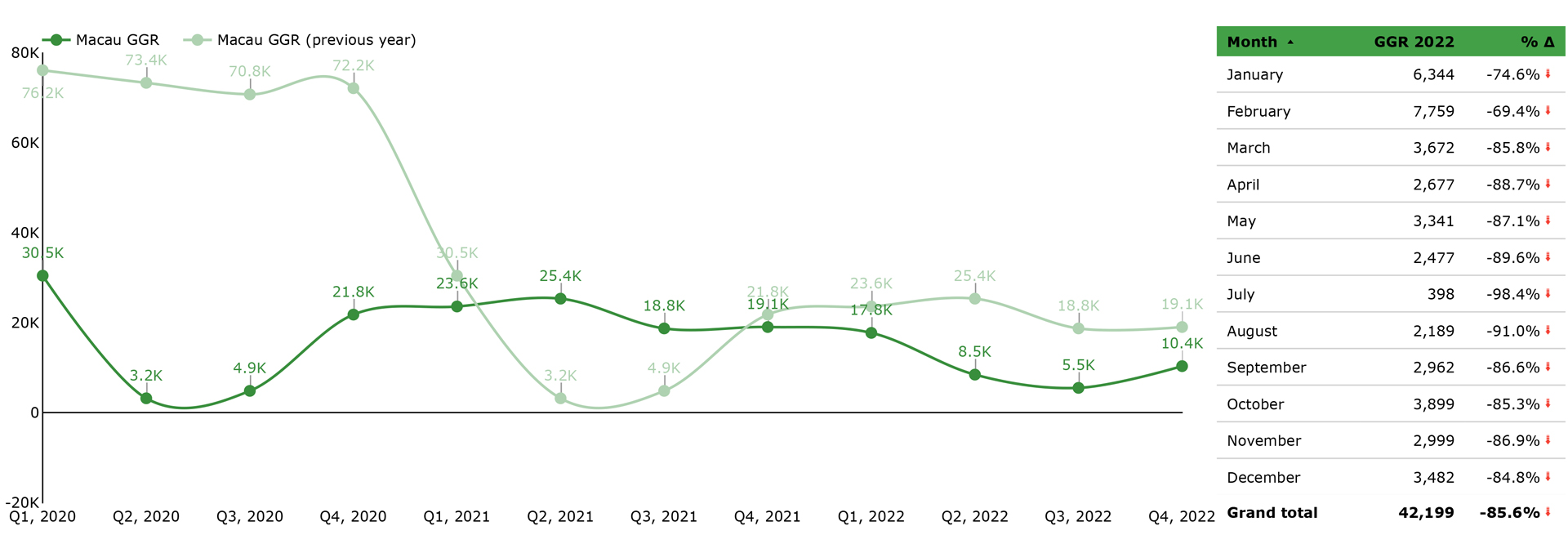

In 2021, GGR reached MOP$86.9 billion (US$10.8 billion) before falling to just MOP$42.2 billion (US$5.2 billion) in 2022. In 2020, the first year of the pandemic in Macau, GGR was MOP$60.5 billion (US$7.5 billion).

However, since 8 January 2023, visitors to Macau from mainland China, Hong Kong and Taiwan no longer have to be tested for COVID-19 while foreign visitors are exempt from quarantine.

Investment bank JP Morgan said in a recent note that GGR for the first eight days of January had reached MOP$2.1 billion (US$261 million) – around 30% of 2019 levels and a significant improvement on GGR levels in 4Q22.

https://www.asgam.com/index.php/2023/01/12/chief-executive-maintains-macau-ggr-forecast-of-mop130-billion-for-2023/

jan23

Zeng Zhonglu, a gaming scholar, has estimated that Macau’s gross gaming revenues could reach up to 70 percent of pre-pandemic levels in 2023, at MOP175.47 billion ($21.84 billion) as the territory aims to rebound from nearly three years of lackluster gaming results under COVID restrictions.

Zeng Zhonglu, from the Macao Polytechnic University’s Gaming Research Team, told public broadcaster TDM that “the most difficult time has now passed” and that the economic recession had “bottomed out”.

The figure bodes well for Macau’s gaming concessionaires, whose new licenses came into effect on January 1st, with expectations for increased visitation due to pent-up demand, despite Macau’s health secretary estimating that about half of the population has COVID.

Numerous countries, including South Korea, the United States and Australia are now requiring negative nucleic acid test results from arrivals from China, Hong Kong and Macau, which could slightly dampen visitation for those wishing to travel on to those markets.

Speaking to the broadcaster, the scholar also noted his prediction was based on the strong rebound seen in Las Vegas after COVID measures were relaxed and business ramped back up, seeing GGR reach over $13.4 billion in 2021, even better than 2019.

Zeng is also estimating that January GGR could recover to 40 to 50 percent of the same month in 2019.

Officials are also closely watching the industry to push economic recovery in the SAR, with the city’s top official in his New Year’s address noting that Macau had successfully changed its gaming law and undergone the gaming concession tender, paving the way forward for Macau to progress in 2023.

https://agbrief.com/news/macau/03/01/2023/gaming-scholar-predicts-macau-ggr-to-reach-up-to-70-percent-of-pre-pandemic-levels-in-2023/?utm_source=Asia+Gaming+Brief&utm_campaign=7ce57a687f-EMAIL_CAMPAIGN_5_19_2022_13_42_COPY_01&utm_medium=email&utm_term=0_51950b5d21-7ce57a687f-69255637&ct=t(EMAIL_CAMPAIGN_5_19_2022_13_42_COPY_01)&goal=0_51950b5d21-7ce57a687f-69255637

jan23

Macau Casinos Seek Brighter Outlook After Worst Year Since 2004

- Dec. revenue falls 56% year-on-year vs estimate of 57% drop

- Strict Covid Zero rules kept gamblers away for most of 2022

https://www.bloomberg.com/news/articles/2023-01-01/macau-casinos-seek-brighter-outlook-after-worst-year-since-2004?leadSource=uverify%20wall

jan23

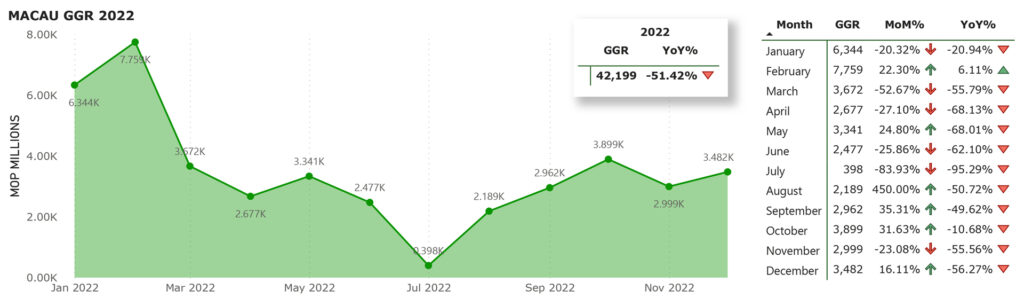

Macau recorded gross gaming revenue of MOP$42.2 billion (US$5.3 billion) in 2022, down 51.4% on 2021 and the lowest single year total since 2004.

The 2022 total, announced by the Gaming Inspection and Coordination Bureau on Sunday, included GGR of MOP$3.48 billion (US$435 million) in December, down 56.3% on December 2021 but higher than November’s GGR total of MOP$3.0 billion (US$373 million).

Macau’s final 2022 GGR result comes as the SAR faces the effects of its long-awaited reopening to the world, with a sudden easing of border restrictions countered by a rapid rise in COVID-19 cases across the city.

https://www.asgam.com/index.php/2023/01/01/macau-records-gross-gaming-revenue-of-us5-25-billion-in-2022-down-51-4-year-on-year/

dez22

A snapshot poll of the websites of Cotai casino resorts by GGRAsia indicates that for at least three of them, many food and beverage (F&B) outlets are currently closed.

No reasons are given. GGRAsia has approached those operators that have confirmed closures in online updates, asking if any of the suspensions are linked to staff shortages associated with a wave of Covid-19 infections in Macau.

Of Cotai resort websites reviewed by GGRAsia, a number mentioned food and drink outlet closures, as well as the temporary suspension of some other facilities.

Galaxy Macau, run by Galaxy Resorts and Entertainment Ltd, gave details in a notice visible on Tuesday, titled “Updates on special operation arrangements” section, with the most recent information said to have been from Monday at 1.20pm

At least 16 food and drink outlets at Galaxy Macau were listed as being “temporarily closed until further notice”.

The notice did not clarify whether any of those places had been shut prior to Covid-19 rule relaxation, or whether staff shortages were a factor in their closure.

A further three outlets were listed as “temporarily closed from 25 to 27 December”.

https://www.ggrasia.com/covid-sweeps-macau-coincides-with-cotai-fb-closures/

dez22

ALVilela

Gross gaming revenue (GGR) generated in the first ten months of the year (MOP 35.7 billion / USD 4.5 billion) fell back to near 2004 levels (MOP 34.1 billion / USD 4.3 billion) when the actual competition started with the opening of Casino Sands on 18 May. That amount (on which the Macau SAR collects 39% as special gaming tax) is about half (49.5%) of the GGR in the same period of 2021 (and 14.5% of that of 2019) and is short of the MOP 130 billion (USD 16.3 billion) forecasted in the MSAR’s budget for 2022. Put into perspective, between January and October, Macau casinos generated the same as in the first 35 days of 2019. The annus horribilis of 2022 registered the lowest monthly GGR ever recorded since market liberalisation in 2002 (MOP 398 million / USD 49.8 million in July) and the first time a monthly threshold of MOP 700 million (USD 87.5 million) was not met.

Macau casino operators’ combined EBITDA fell in the third quarter of the year by about USD 558 million (MOP 4.5 billion). The local gaming industry’s debt stood at around USD 23.3 billion (MOP 187.5 billion), well above the USD 4.8 billion (MOP 38.6 billion) recorded at the end of 2019.

https://www.macaubusiness.com/opinion-state-of-the-nation-and-gaming/

dez22

With China's tough Covid directives and travel restrictions discouraging gamblers, this year will go down as a particularly bad year for the gambling business in Macau, says a Bloomberg report. Casino revenue plummeted 56 per cent from November, 2021 to 3 billion patacas ($374 million), according to the Gaming Inspection and Coordination Bureau, which released its report on Thursday. With that, revenue from January through November was 38.7 billion patacas, which is a significant decrease from the 270 billion patacas earned during the same time period in 2019, pre-pandemic. Analysts had anticipated a 47 per cent dip in revenue to 3.6 billion patacas in November compared to the same month last year.

https://www.wionews.com/world/macau-casinos-to-face-their-worst-year-ever-due-to-covid-restrictions-539092

The Macau government’s estimate for Macau GGR for the 2022 calendar year was MOP$130 billion. Remember that number.

Earlier today, the DICJ announced the November GGR was a paltry MOP$3.0 billion, making Macau’s actual 2022 GGR for the first 11 months a total of MOP$38.7 billion.

Let’s extrapolate that number to a 12-month equivalent run rate: MOP$38.7 billion x 12/11 = MOP$42.2 billion (US$5.3 billion). Given we’re 11 months into the year, that will be a quite accurate estimate of the actual 2022 GGR.

That run rate as a percentage of the original government estimate is 42.2 billion divided by 130 billion which is a mere 32%! That’s just under one third of the original estimate — which itself was only 44% of 2019 (pre-pandemic) GGR.

Meanwhile, the state of Nevada just recorded its 20th month in a row with GGR well north of US$1 billion. Its revenue for the 10 months to October stands at US$12.3 billion, with a 12-month equivalent run rate of 12.3 billion x 12/10 = US$14.8 billion, nearly triple the Macau 2022 GGR run rate. Long gone are the days of Macau being five, six, seven times Las Vegas. These days it’s more like half of Las Vegas, and a third of Nevada as a whole.

And the government’s estimate for Macau GGR for 2023? MOP$130 billion. Does that number sound familiar?

https://www.asgam.com/index.php/2022/12/01/macau-2022-ggr-running-under-a-third-of-government-estimate/

nov22

Macau gaming sector stocks had “until very recently” been “abandoned by investors” and had “massively underperformed” gaming and lodging peers covered by JP Morgan Securities LLC, noted a Monday report from the institution. But, “as we head into 2023, we think Macau has the most upside within our coverage universe,” suggested the investment bank.

The lack of investor interest in Macau names had been due to “extremely limited travel mobility to Macau,” under “China’s zero-Covid policy”, stated JP Morgan.

Other factors had been “investors’ concerns over licensing renewal risk and related terms,” including the possibility of “mandated uneconomic capital expenditure” being required by bidders in the public tender for new, 10-year concessions, added the paper from analysts Joseph Greff, Omer Sander, Daniel Adam, and Ryan Lambert.

https://www.ggrasia.com/investor-abandoned-macau-has-comeback-path-jpm/

nov22

Macau Chief Executive Ho Iat-Seng said Tuesday that even though the COVID-19 pandemic had caused three straight years of significant losses to the city’s gaming concessionaires, the situation would not cause them to close down.

Speaking to reporters at a press conference on Tuesday following his 2023 Policy Address, Ho responded to questions expressing concern for the economic situation of Macau’s six concessionaires, who have now reached 11 consecutive quarters of losses, insisting that the benefits they have generated over the past 20 years have been enough to outweigh any short-term woes.

https://www.asgam.com/index.php/2022/11/16/ho-iat-seng-three-years-of-losses-wont-put-macaus-concessionaires-out-of-business/

nov22

Macau’s gaming concessionaires reported combined Property EBITDA losses of US$558 million in the three months to 30 September 2022, according to data compiled by Deutsche Bank Securities.

In a market recap published Friday after the last of Macau’s six concessionaires released their 3Q22 results, Carlo Santarelli – Managing Director of Deutsche Bank’s Gaming & Lodging Research – said industry margins had fallen by 65% versus 3Q19 on an 89% decline in net revenue, resulting in the US$558 million EBITDA loss.

Analysts had previously predicted EBITDA losses in the vicinity of US$600 million.

https://www.asgam.com/index.php/2022/11/14/macau-concessionaires-reported-combined-us558-million-ebitda-loss-in-3q22-deutsche-bank/

out22

MGM China's (2282.HK) Cotai casino in Macau was locked down on Sunday after a dealer tested positive for COVID-19, city authorities in the world's biggest gambling hub said, ordering everyone inside to stay put until Nov 1.

MGM did not immediately respond to a request for comment.

The closure deals a blow to casino operators who have already been grappling with COVID restrictions for more than two and a half years.

"Casinos, hotel staff and hotel guests will be quarantined in place immediately," the city government said in a statement, adding that all stores and restaurants attached to the hotel resort would also remain shut.

Government health workers were at the MGM Cotai site with noone allowed to enter or exit the building, industry publication Inside Asian Gaming said.

https://www.reuters.com/world/asia-pacific/macaus-mgm-cotai-casino-locked-down-after-dealer-infected-with-covid-media-2022-10-30/Information from the Statistics and Census Service (DSEC) indicated that number of enterprises engaged in gaming activities stayed at 9 in 2021. Total receipts of the gaming sector increased by 42.0% year-on-year to MOP90.81 billion owing to the recovery of tourism activity following a rebound in number of visitor arrivals to Macao; gaming receipts (MOP87.54 billion) grew by 45.1% whereas interest receipts (MOP2.61 billion) dropped by 1.7%. Despite a pickup compared to 2020, total receipts in 2021 corresponded to only about 30% of those in 2019.

out22

Um artigo de opinião publicado no Diário do Povo assegurou que a política dinâmica de zero casos é para manter no futuro. O texto levou alguns investidores a desfazerem-se das acções das operadoras de jogo que operam em Macau

out22

Macau will still remain the ‘best game in town’ for mainland punters – Fitch Ratings analyst

ag22

Macau will remain as a “very profitable” market for gaming operators, as the capital expenditure for the next decade is not expected to be as high as in the past while the local mass market will gradually recover, Praveen Choudhary, an analyst from brokerage Morgan Stanley Asia, said.

He made the remarks today (Wed) in a conference session about Asian gaming destinations held on the first day of G2E Asia 2022 Special Edition: Singapore, a three-day gaming industry trade show being held for the first time in the Southeast Asian country.

https://www.macaubusiness.com/macau-to-remain-as-a-very-profitable-market-for-gaming-operators-morgan-stanley/

jul22

Especialistas do jogo disseram à Lusa que a indústria do jogo em Macau vai ter de se habituar a viver com menos lucros, mesmo num futuro sem as restrições e impacto causado pela pandemia de covid-19.

O diretor executivo da empresa especializada em jogo 2NT8, Alidad Tash, estimou que os lucros dos casinos caíram para cerca de metade do que se registava antes da pandemia, mas ressalvou que também terão pela frente menos riscos.

"Penso que o negócio dos casinos continuará a ser rentável. Não tanto como antes, mas ainda assim, um lucro saudável. E a boa notícia para os casinos é que eles gastaram milhares de milhões de dólares a construir luxuosas estâncias integradas. No futuro, não estarão a gastar tanto em novas infraestruturas. Portanto, o risco é menor. Dito de outra forma, terão menos lucro do que antes, mas também com menos risco", sintetizou.

https://www.rtp.pt/noticias/economia/industria-do-jogo-em-macau-vai-ter-de-se-habituar-a-viver-com-menos-lucros-analistas_n1421918

jul22

Macau’s Secretary for Administration and Justice, André Cheong Weng Chon, said Saturday that the SAR is currently experiencing a COVID-zero period but that this would be followed by a longer “consolidation period”.

Asked by Inside Asian Gaming during the daily 5pm press conference exactly what this consolidation period would entail and which businesses would be allowed to open, Cheong replied, “During the consolidation period, social facilities will be opened gradually, but restaurants will still not be allowed to have dine-in food, and gymnasiums and beauty salons will not be allowed to open.”

However, the government did not explain when the “consolidation period” would end, nor whether casinos would be allowed to reopen. All Macau casinos have been closed since 11 July and will remain so until at least 23 July after the current lockdown measures were extended by five days on Saturday.

https://www.asgam.com/index.php/2022/07/17/casino-fate-unknown-as-macau-prepares-for-covid-consolidation-period/

jul22

CASINOS REGISTARAM SEMESTRE MAIS FRACO DOS ÚLTIMOS 16 ANOS

jul22

A corretora JP Morgan avisa que as medidas impostas pelo Governo de Macau para lidar com o surto de Covid-19 na comunidade irão deixar as concessionárias de jogo praticamente sem receitas durante o terceiro trimestre deste ano.

https://pontofinal-macau.com/2022/07/12/politica-de-zero-casos-vai-deixar-casinos-com-zero-receitas-avisa-jp-morgan/

jun22

In a recent note, Morgan Stanley analysts estimated that Macau’s six concessionaires were losing a combined US$800 million per quarter, with their combined debts since the start of the pandemic rising from around US$5 billion to more than US$20 billion. And this was before the June COVID outbreak in Macau which has many fearing that gross gaming revenues will decline even further to near-zero for the foreseeable future.

Under such a scenario, at least two concessionaires – Sands China and SJM – are facing shortened liquidity runways of just nine months according to JP Morgan, even with SJM having just weeks earlier finally agreed a long-awaited refinancing of existing loans.

The new reality for concessionaires was highlighted by Wynn Macau Ltd which announced on 14 June that it had been provided a US$500 million revolving loan facility by its parent, Wynn Resorts. This, analysts explained, was likely a sign that Macau’s once prosperous casino operators are now so deep in the hole that banks are no longer eager to help bail them out.

The good news for the concessionaires – cash-rich Galaxy Entertainment Group aside – is that most have strong parent firms ready and willing to lend a hand where needed, much like in the case of Wynn. And, as we’ve seen in markets like the United States, Australia and the Philippines, pent-up demand upon reopening is a very real thing.

https://www.asgam.com/index.php/2022/06/29/editorial-are-macaus-casinos-running-out-of-money/

jun22

Only two of Macau’s 18 satellite casinos – the Rio Casino and the President Casino – have closed amid changes to the city’s regulatory system for such properties, and against the backdrop of the city’s six gaming concessionaires having their respective gaming contracts extended by circa six months, to December 31.

It had been reported previously in local Chinese-language media – citing sources that were not identified – that more than two satellites might close at the point of the original June 26 expiry date for Macau licences, due to concerns that coming regulatory adjustments would make their business model unworkable.

https://www.ggrasia.com/only-2-macau-satellites-closed-as-concessions-extended/

mai22

Six casinos in Macau are facing $25bn net debt by the end of the year and $27bn by 2024.

China’s stringent travel restrictions have slowed Macau’s economic recovery since the height of the COVID-induced lockdown, leading to desperate times for many businesses. Morgan Stanley estimates provided the $25bn figure, citing an increase in previous debt from $5bn in 2019 to $20bn.

https://www.vegasslotsonline.com/news/2022/05/24/six-macau-casinos-facing-25bn-debt-by-the-end-of-2022/

mai22

Any light at the end of the tunnel for Macau’s casino operators may just have been extinguished after Chinese President Xi Jinping doubled down on his hardline zero-COVID strategy.

In the wake of suggestions that recent outbreaks across parts of mainland China, including Shanghai and Beijing, might lead to a gradual easing of zero-COVID, Xi instead told a meeting of the Politburo Standing Committee (PBSC) late last week that the nation must strengthen its efforts in combatting the virus.

Officials must, Xi said, “Align their thinking and actions and maintain a high degree of ideological, political and action unity with the Party Central Committee,” according to information from state-run news agency Xinhua.

https://www.asgam.com/index.php/2022/05/10/macau-operators-on-notice-as-xi-jinping-doubles-down-on-hardline-zero-covid-strategy/

mai22

Macau recorded gross gaming revenue of MOP$2.68 billion (US$335 million) in April, down 68.1% year-on-year and 27.1% lower than March — itself a record low for 18 months — according to information from the Gaming Inspection and Coordination Bureau.

The April figure was Macau’s worst since September 2020, when GGR was MOP$2.21 billion (US$274 million), and was 88.6% lower than April 2019 GGR of MOP$23.58 billion (US$4.71 billion).

https://www.asgam.com/index.php/2022/05/01/macau-records-ggr-of-mop2-68-billion-in-april-worst-in-19-months/

ab22

Mass market baccarat continued to dominate Macau’s gaming landscape in the three months to 31 March 2022, with its share of industry-wide gross gaming revenue continuing to climb according to figures from the DICJ.

While Macau GGR plummeted to just MOP$17.94 billion (US$2.22 billion) in 1Q22 – its lowest level since the third quarter of 2020 – mass baccarat comprised 60.3% at MOP$10.82 billion (US$1.34 billion). That compares to 50.6% of GGR in the same quarter last year and 42.4% in 4Q19, the last quarter before COVID-19 impacted revenues.

https://www.asgam.com/index.php/2022/04/20/mass-baccarat-contributed-60-of-all-macau-ggr-in-1q22-dicj/

1/4

Macau records GGR of MOP$3.67 billion in March, worst in 18 monthshttps://www.asgam.com/index.php/2022/04/01/macau-records-ggr-of-mop3-67-billion-in-march-worst-in-18-months/?utm_source=IAGMM&utm_campaign=756bc6ee55-IAGBB_BN_20201201_COPY_01&utm_medium=email&utm_term=0_41ef01e2c9-756bc6ee55-131421005

mar22

Some Macau concessionaires could run out of cash in as little as three months at current run rates, with the industry losing US$800 million and leaking US$250 million in cash flow each quarter, according to investment bank Morgan Stanley.

The dire predicament, outlined in a research report published this week, suggests that SJM Holdings could use up all if its cash in three months at the 4Q21 FCFE (free cash flow to equity) run rate, although it has another US$170 million undrawn revolver it can access to extend its lifeline.

Also racing the clock, the report says, are Sands China and MGM China with around nine months (three quarters) worth of cash each, while Wynn Macau has around 15 months and Melco Resorts 18 months of cash available.

Galaxy Entertainment Group is the only one of Macau’s six concessionaires facing no such issues since it is FCF (free cash flow) positive and has a US$5 billion war chest at its disposal.

https://www.asgam.com/index.php/2022/03/29/macau-concessionaires-running-low-on-cash-as-quarterly-losses-reach-us800-million-morgan-stanley/

mar22

At least seven satellite casinos are expected to stop operations by mid-year due to lack of cash flow, and limited visitation due impact of covid-19 outbreaks and visa challenges, according to a report from Macao Daily.

The satellite casinos are reportedly located in Nape and Taipa, and are planning to stop operations to reduce further loss amid an unstable business environment.

There are currently 18 satellite casinos operating in Macau, most of which fall under the concession of SJM Holdings.

Industry insiders speaking to Macao Daily said that the satellite casinos have suffered particularly from restrictions on mainland residents’ visa applications to Macau, as well as Macau’s zero-covid pandemic policy, which has restricted visitation.

https://agbrief.com/news/macau/25/03/2022/seven-satellite-casinos-to-close-shop-by-mid-year-report/

The four satellite casinos operated by former Macau legislator Chan Meng Kam’s Golden Dragon Group are said to be among seven satellites planning to close their doors this year ahead of expected amendments to the city’s gaming law.

Following a report by Macao Daily late last week claiming seven casinos would cease operations by mid-2022, Chinese-language media outlet Allin Media named those seven as including Golden Dragon Group’s Casino Golden Dragon, Casino Royal Dragon and Casino Million Dragon – all operating under the license of SJM Resorts – and Grand Dragon Casino which operates under the license of Melco Resorts.

https://www.asgam.com/index.php/2022/03/28/golden-dragon-group-to-shutter-all-four-macau-satellite-casinos-by-mid-2022-more-to-follow-report/

mar22

The combined debt of Macau’s six concessionaires has quadrupled from US$5 billion to more than US$20 billion since the start of the COVID-19 pandemic, one of multiple factors currently driving down stock prices according investment bank Morgan Stanley.

In a research note published this week, analysts Praveen Choudhary and Gareth Leung said industry debt had climbed to US$19 billion by the end of 2021 and could reach US$23 billion end-2022, driving down valuations.

COVID-19 outbreaks in mainland China and Hong Kong are also contributing factors, as is uncertainty over the amended Macau gaming law and license renewal – although the latter concerns have largely been addressed in recent weeks.

https://www.asgam.com/index.php/2022/03/17/net-debt-of-macau-operators-now-four-times-higher-than-2019-morgan-stanley/

mar22

The Morgan Stanley banking group says “normalisation” in earnings before interest, taxation, depreciation and amortisation (EBITDA) for the Macau casino industry “may only happen in the second half of 2023 or in 2024.” The institution warned that net debt in the sector “could swell to US$23 billion” by the end of 2022.

In a Tuesday note, analysts Praveen Choudhary and Gareth Leung said it was “safe to assume that pent-up demand should drive future revenue and EBITDA in Macau to surpass pre-Covid levels.” In full-year 2019, before the onset of the pandemic, gross gaming revenue in the Macau market was nearly MOP292.5 billion (US$36.3 billion), while corporate EBITDA stood at about US$9.2 billion.

https://www.ggrasia.com/macau-op-ebitda-normalisation-in-2h23-at-earliest-ms/

mar22

Apesar de ser um dos mercados mais afectados pela pandemia, Macau manteve em 2021 o título de “capital mundial do jogo”, pelo 16º ano, embora a vantagem sobre Las Vegas tenha sofrido uma redução expressiva. Beneficiando da procura reprimida e da flexibilização das medidas de prevenção epidémica, a “strip” de Las Vegas arrecadou o maior volume de receitas da sua história, equivalente a 65,3% do total dos casinos de Macau. Em termos absolutos, 30,1 mil milhões de patacas separaram a facturação dos maiores mercados do jogo, indicam dados dos reguladores das duas jurisdições analisados pelo Jornal TRIBUNA DE MACAU

https://jtm.com.mo/local/recorde-em-las-vegas-equivaleu-65-de-macau-em-crise/

mar22

A operadora de jogo Melco Resorts & Entertainment, com quatro casinos em Macau, registou perdas de 575,5 milhões de dólares (518,8 milhões de euros) em 2021.

mar22

Macau GGR climbs 22.3% month-on-month to MOP$7.76 billion in February

fev22

GALAXY PAGA DIVIDENDOS

A recovery in Macau’s casino industry will continue, even if its near-term outlook remained challenging because of recent surges in Covid-19 cases in neighbouring Hong Kong and mainland China, analysts said.

The comments came as casino operator Galaxy Entertainment, which is owned by Hong Kong property tycoon Lui Che-woo, reported net profits of HK$1.33 billion (US$170 million) for the full year of 2021. The results, announced in an exchange filing last week, beat analyst expectations and reversed a HK$3.9 billion loss in 2020.

Galaxy also announced a special dividend of 30 Hong Kong cents per share, which “attests to our confidence in Macau, our financial strength and our future earnings potential”, Lui said in the filing. The total estimated amount of the dividend to be distributed was around HK$1.3 billion, which will be paid on or around April 29.

https://www.scmp.com/business/article/3168425/macau-casino-firm-galaxy-entertainments-turnaround-shows-sector-has?utm_source=cm&utm_medium=txn&utm_campaign=enlz-NOT-Follow&utm_content=20220227&d=109efd5f-1e89-45c7-a29a-4b8b363dfce8

fev22

Some Macau hotels saw occupancy reach 100% at times during the Chinese New Year holiday period, according to SJM Holdings Co-Chairman and Executive Director Angela Leong.

Speaking to local Chinese media this week after the Macao Government Tourism Office revealed the average occupancy rate of Macau’s hotels during CNY had grown 15.2% year-on-year to 63.8%, Leong said the performance of some SJM hotels had been particularly strong.

“There were a few days during CNY [at] some of our hotels, the hotel’s occupancy rate was 100%,” she said.

“Some of them reached 60% to 70%, so the overall performance I think was good.”

https://www.asgam.com/index.php/2022/02/11/some-sjm-hotels-reached-100-occupancy-during-cny-angela-leong/

fev22

MGM China surprised analysts with the outperformance of its mass market gaming over the Chinese New Year, which returned to 85 percent of pre-pandemic levels in terms of table drop. https://agbrief.com/news/macau/10/02/2022/mgm-china-surprises-announcing-mass-hits-85-pre-covid-levels-over-cny/?utm_source=Asia%20Gaming%20Brief&utm_campaign=05567f6c1d-&utm_medium=email&utm_term=0_51950b5d21-05567f6c1d-69255637&ct=t%28%29&goal=0_51950b5d21-05567f6c1d-69255637

A MGM China fechou 2021 com ganhos operacionais de cerca de 390 milhões de dólares de Hong Kong, mas os resultados brutos caíram nos últimos três meses, em parte devido a um aumento de 13 milhões em dívidas de cobrança duvidosa relacionadas com o fecho de salas VIP. A empresa mantém-se “cautelosamente optimista” sobre a recuperação do mercado https://jtm.com.mo/local/dividas-vip-afectam-contas-da-mgm/

fev22

The gaming performance during the Chinese New Year (CNY) holiday period this year was “one of the best results” since the start of the Covid-19 pandemic more than two years ago, said Linda Chen, vice-chairman and chief operating officer of Wynn Macau Ltd.

Speaking with local media on the sidelines of a public event today (Wednesday), the executive of the Macau gaming operator stated: “The occupancy rate of our hotels was also almost full in this [CNY] holiday… reaching 99 per cent or above.”

“The overall performance [of CNY] has matched our expectations,” Ms. Chen added.

https://www.macaubusiness.com/2022-cny-boasts-one-of-the-best-gaming-results-since-covid-19-wynn-macau/

Fev22

Macau casino operator MGM China Holdings Ltd saw its table drop in the mass-market segment reach 85 percent of pre-pandemic levels during the Chinese New Year (CNY) holiday break, said Hubert Wang, the firm’s president and chief operating officer. The executive also confirmed plans to reallocate resources from its VIP business to the mass market “in the coming quarters”.

“We were pretty satisfied with the performance during Chinese New Year, particularly on the mass side,” Mr Wang told an investor conference call on Wednesday after the announcement of the fourth-quarter results of MGM Resorts International, the parent of MGM China.

He added: “At MGM, I think we have reached 85 percent of the pre-pandemic levels in terms of mass volume, if we measure that in terms of drop; that’s encouraging.”

Macau’s casino industry performance for Chinese New Year was “better than expected”, stated a number of investment analysts earlier this week. Brokerage Sanford C. Bernstein Ltd estimated casino gross gaming revenue during the holiday break as being up by about 60 percent versus the festive period in 2021. https://www.ggrasia.com/mgm-chinas-cny-mass-drop-85pct-of-pre-covid-coo/